Josh Aharonoff

Jun 8, 2023

Welcome to an information-packed edition of Legit Numbers!

Brace yourself for a dashboard extravaganza as I unveil 7 incredible chart templates fused into one comprehensive dashboard. I'll also delve into the significance of Inventory Accounting and explore the essential Startup KPIs.

What we’ll be covering in this edition:

7 Chart Templates…wrapped into one Dashboard

Learn about Inventory & Accounting

24 Startup KPIs

Let’s get started

This Dashboards contains some of my favorite methods for presenting financial data in excel

Let’s dive into each concept:

1️⃣ The Donut

This is great for displaying a % of something - you may recognize the style from your your apple watch on the battery meter

My favorite use for this chart is with a budget vs actuals (ex: 80% hit on revenue target)

2️⃣ The Pie Chart

This is best for showcasing the split between different categories

In this example, I chose to split opex by category

3️⃣ The Bar Chart

Bar Charts help you showcase data across a timeline

In this example, we are showcasing ending cash

4️⃣ The Line Chart

Line charts are similar to bar charts in that they help you showcase information across a time period

I am extra fan of line charts when you have multiple series, and you want to show them intersect

In this example, we showcase the breakeven point, when profits intersect with costs

5️⃣ The Combo Chart

This chart is a combination of charts 2 and 3, and is great to showcase 2 different series, ideally on a different axis (ex: Revenue on one axis, gross margin on another)

6️⃣ The KPI

This one is entirely custom, and is one of my favorite ways of conveying financial data

In this case, we’re showcasing our performance on various KPIs, compared to last year

7️⃣ The Table

This may be the most common method of showcasing data - but it doesn’t have to be boring!

Common uses are a summarized P&L, Balance Sheet, or Cash Flows

What are some other ways that you prsent financial data?

Get the 7 Chart Templates from my website by clicking the image below

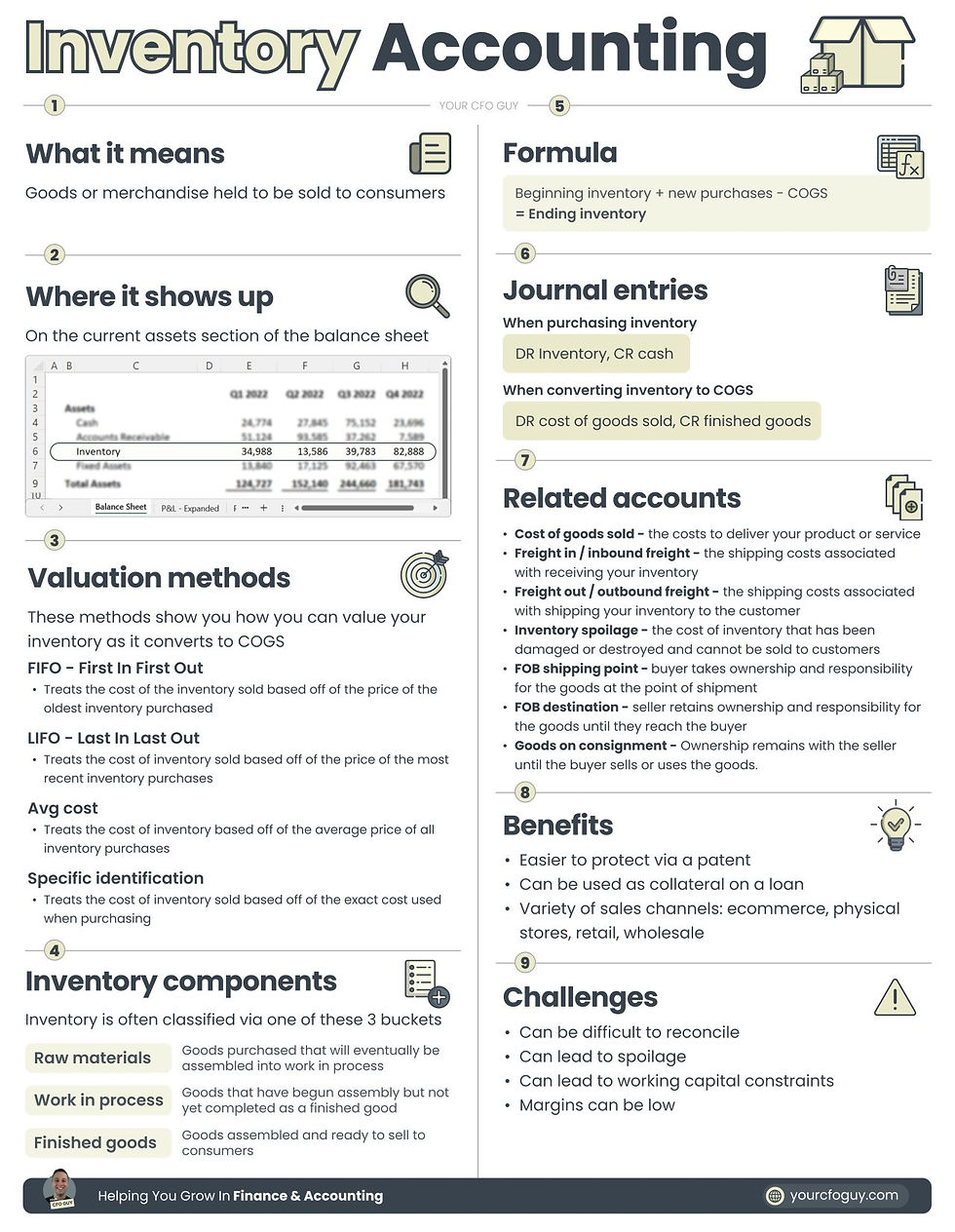

➡️ What it means → goods that will be converted into finished products to be sold to consumers

➡️ Where it shows up → on the current assets section of the balance sheet

➡️ Valuation methods → these methods show you how you can value your inventory as it converts to COGS

1️⃣ FIFO - First In First Out

Treats the cost of the inventory sold based off of the price of the oldest inventory purchased

2️⃣ LIFO - Last In First Out *(infographic has a typo)

Treats the cost of inventory sold based off of the price of the most recent inventory purchases

3️⃣ Avg cost

Treats the cost of inventory based off of the average price of all inventory purchases

4️⃣ Specific identification

Treats the cost of inventory sold based off of the exact cost used when purchasing

➡️ Inventory components - inventory is often classified via one of these 3 buckets

1️⃣ Raw materials - goods purchased that will eventually be assembled into finished goods

2️⃣ Work in process - goods that have begun assembly but not yet completed as a finished good

3️⃣ Finished goods - goods assembled and ready to sell to consumers

➡️ Formula

Beginning inventory

+ new purchases

- COGS

=ending inventory

➡️ Journal entries

1️⃣ When purchasing inventory → DR Inventory, CR cash

2️⃣ When converting inventory to COGS → DR cost of goods sold, CR finished goods

➡️ Related accounts

▪️ Cost of goods sold - the costs to deliver your product or service

▪️ Freight in / inbound freight - the shipping costs associated with receiving your inventory

▪️ Freight out / outbound freight - the shipping costs associated with shipping your inventory to the customer

▪️ Inventory spoilage - the cost of inventory that has been damaged or destroyed and cannot be sold to customers

▪️ FOB shipping point - buyer takes ownership and responsibility for the goods at the point of shipment

▪️ FOB destination - seller retains ownership and responsibility for the goods until they reach the buyer

▪️ Goods on consignment - Ownership remains with the seller until the buyer sells or uses the goods.

➡️ Benefits

👍 Easier to protect via a patent

👍 Can be used as collateral on a loan

👍 Variety of sales channels: ecommerce, physical stores, retail, wholesale

➡️ Challenges

😕 Can be difficult to reconcile

😕 Can lead to spoilage

😕 Can lead to working capital constraints

😕 Margins can be low

That’s my take on inventory - what would you add?

Gross Margin → Gross Profit / Revenue

Cash Burn → Cash consumed, not factoring in financing activities

Churn → Lost revenue / customers who are no longer active

EBITDA Margin → EBITDA / Revenue

Customer Acquisition Cost → Cost to acquire a customer

Customer Lifetime Value → Total expected revenue from a customer over their lifetime

EBITDA → Net Income + Interest + Taxes + Depreciation + Amortization

Monthly Recurring Revenue → Revenue from customers subscribed to monthly recurring plans

Net Dollar Retention → Net revenue / opening MRR

Annual Recurring Revenue → Revenue from customers subscribed to Annual recurring plans

CAC Payback → Period of time till you make back your Customer Acquisition Cost

Sales Attainment → % of quota attained by sales team

Average Contract Value → Total Revenue / # of Contracts (B2B)

Expansion Revenue → Added Revenue from recurring customers

Contraction revenue → Reduced revenue from recurring customers

Budget Attainment → % of your budget achieved

Average Revenue per User →Total Revenue / # of Users (B2C)

Net Promoter Score → Used to measure customer loyalty based off of likelihood to refer

Runway → How many months till you run out of cash

Revenue run rate → This months revenue * 12

Gross Profit → Revenue - COGS

Cash out date → Date in which you run out of cash

Net Income → Revenue - COGS - Operating Expenses + Other Income - Other Expenses

Operating Expenses → Company Expenses not related to your Cost of Goods Sold, or Other Expenses

Did I miss any?

And that concludes another enlightening edition of Legit Numbers.

I hope you found valuable insights in this week's digest on chart templates, Inventory Accounting, and Startup KPIs.

Stay tuned for more exciting content in the weeks to come.

Until next time, keep mastering Finance & Accounting!