Josh Aharonoff

May 11, 2023

Welcome to another edition of Legit Numbers - the weekly digest that helps you master Finance & Accounting!

This week, I have some special treats for you, including cheat sheets that will make your life easier and a comparison of two key accounting terms, and more.

Plus, I’ll share with you some insights on finance and accounting roles and a popular business model.

What we’ll be covering in this edition:

Free Accounting Cheat Sheet

Free Financial Statements Cheat Sheet…with the full encyclopedia

Accounts Payable vs Accounts Receivable

33 Finance & Accounting roles

Software as a Service (SaaS) Cheat Sheet

Let's dive in...

Free Accounting Cheat Sheet

This infographic contains close to everything I learned while getting my degree in Accounting

Looking to get a copy of this Cheat sheet? Like & comment below

Here’s what’s included:

➡️ The Accounting Equation → Assets = Liabilities + Owners Equity

This shows you how your balance sheet must always tie.

Items of economic value (assets)

were funded by capped amounts owed to creditors (liabilities)

and uncapped amounts owed to owners

➡️ Debits & Credits → Debits & Credit showcase which accounts on your General Ledger are increasing or Decreasing. They must always equal each other

➡️ Cash vs Accrual

The Cash basis → treats money in as income, and money out as expenses

The Accrual basis → treats money earned as income, benefits incurred as expenses

➡️ GAAP vs IFRS

GAAP → stands for Generally Accepted Accounting principles, primarily used in the US.

IFRS → stands for International Financial Reporting Standards, and is used for reporting internationally

➡️ Bank Reconciliations → Bank reconciliations allow you to confirm the bank balance shown on our general ledger to your bank account. This is the most important part of a month end close

➡️ Chart of Accounts → These are the accounts that show up on your income statement and balance sheet (or general ledger)

➡️ The 3 Financial Statements

Profit and Loss → what you are earning vs consuming)

Balance Sheet → A snapshot in time showing items of economic value, capped amounts owed to creditors, and uncapped amounts owed to owners

Cash Flows → movements in your cash flows, prepared by either the direct or indirect method

➡️ 10 Accounting interview Questions → these questions are common to be asked in an interview, and can help reveal just how strong your foundation in accounting is

➡️ 10 Common Adjusting Journal Entries → these journal entries are often times booked as part of a month end close

➡️ Balance Sheet Ratios → these ratios involve the balance sheet, allowing you to get key insights

➡️ Cash Flow Ratios → these ratios allow you to understand different metrics around your cash, which is your most important asset

➡️ Profitability Ratios → these ratios help you understand the different levels of profitability in your business

Get a copy of this cheat sheet by clicking the image below below

This cheat sheet contains close to everything I know about the Financial Statements

And the encyclopedia of resources below will help you master it all

➡️ Overview of Financial Statements

The 3 financial statements https://lnkd.in/ecqanjSx

A guide to the financial statements https://lnkd.in/ecDVjABa

Understand all 3 statements https://lnkd.in/eUw5cj8z

Financial statements 101 https://lnkd.in/e2ZbRuWu

Understand Financial Statements in less than 2 minutes https://lnkd.in/etWuZ-Xi

➡️The Profit & Loss

The Profit & Loss https://lnkd.in/eDspfRQX

Build a Profit & loss https://lnkd.in/eVeiwxAD

24 Startup Profit & loss https://lnkd.in/ekfg6eQQ

➡️ The Balance Sheet

The Balance Sheet https://lnkd.in/eFDAMQnQ

Analyze a business with just a balance sheet https://lnkd.in/ev4vkssq

Understand a Balance sheet in 24 seconds https://lnkd.in/eTmGV8qB

The sections of the balance sheet (with examples) https://lnkd.in/eBm7xGsq

➡️ The Statement of Cash Flows

The Statement of Cash Flows https://lnkd.in/eK4cs8qz

Direct vs Indirect Method https://lnkd.in/en-yDyER

The Sections of the Cash Flows https://lnkd.in/eHrY66Cv

➡️ Other Relevant Info

The Chart of Accounts https://lnkd.in/e-Hp9HEv

The Difference between a P&L and a balance sheet https://lnkd.in/e5csDcrM

Difference between Gross Profit, Net Income, EBITDA, and Cash Flows https://lnkd.in/e22Pid_i

Cash vs Accrual https://lnkd.in/ePfkkTXq

COGS vs Opex https://lnkd.in/e8muSfVd

Accounts Receivable https://lnkd.in/eVtxh735

Accounts Payable https://lnkd.in/ewqihm7w

Prepaid expenses https://lnkd.in/ezaJREcT

Gross Profit & Gross Margin https://lnkd.in/er6sX2WW

Retained Earnings https://lnkd.in/ec6Ur8ei

Deferred Revenue https://lnkd.in/egj2Fqm8

I hope this cheat sheet + encyclopedia gives you the value it’s given me in my career

Get a copy of this cheat sheet by clicking the image below below

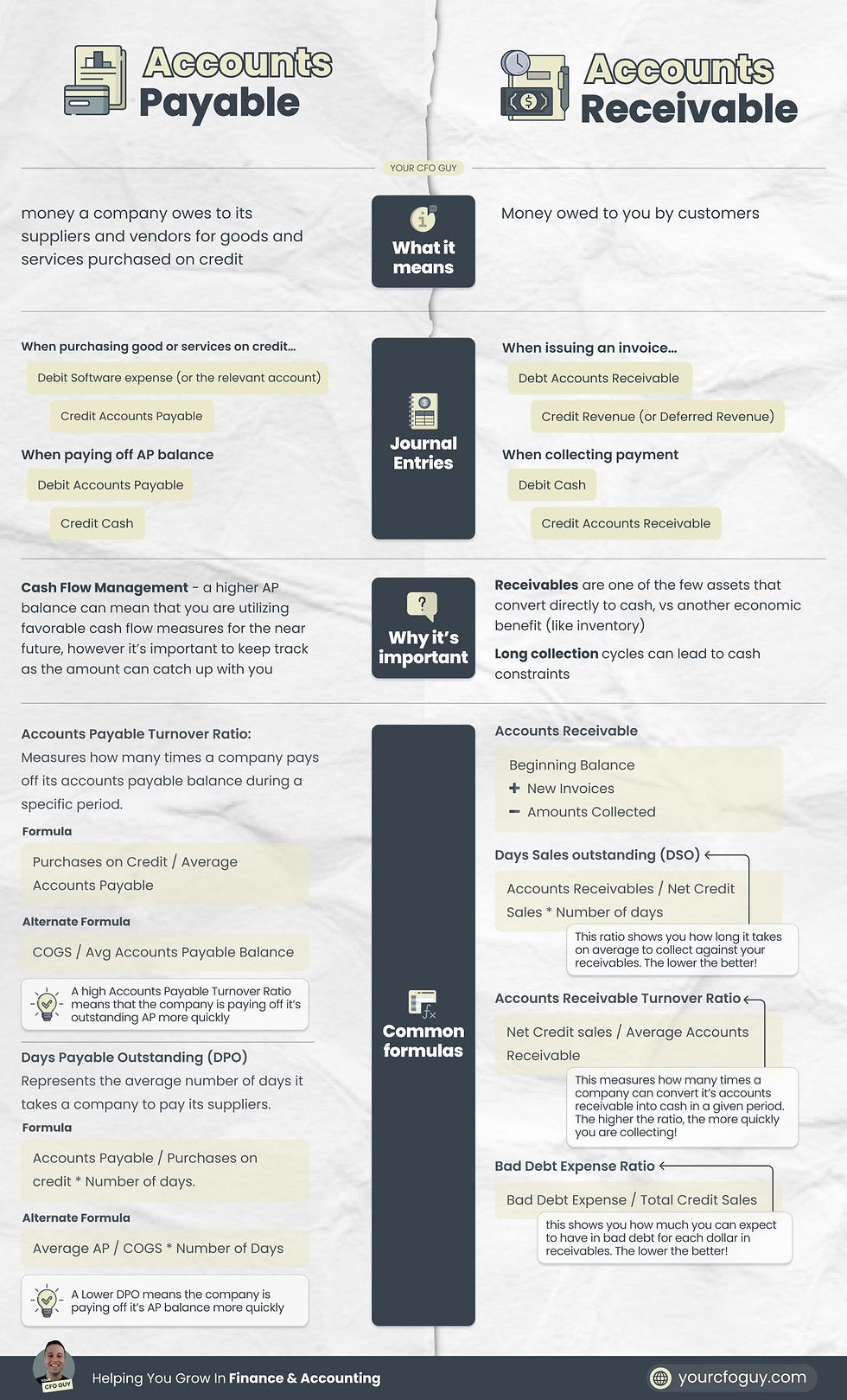

They are the yin and yang of the money you OWE and the money you’re OWED

Each have their own quirks, and ways to analyze

Let’s get into it

➡️ What do they mean?

Accounts Payable → Money you owe to suppliers for goods or services purchased

Accounts Receivable → Money customers owe you for sales generated but not yet paid

➡️ Where do they show up on your financial statements?

They are both part of your working capital, and appear on your balance sheet

Accounts Payable → Current Liabilities

Accounts Receivable → Current Assets

The movements in these accounts get shown on your statement of cash flows in your Cash from Operating Activities

➡️ What are the journal entries?

Accounts payable → Goes up with a credit, and down with a debit

Accounts receivable → Goes up with a debit, down with a credit

➡️ Why are they important?

These 2 accounts can cause wild swings in your cash flows

Accounts Payable → the more favorable your credit terms with suppliers, the stronger your cash position

Accounts Receivable → the quicker you collect your cash, the less bad debt, and the more favorable your cash position

➡️ What are some formulas around these?

1️⃣ Accounts Payable Formulas:

Accounts Payable Turnover → this measures how many times a company pays off its accounts payable balance in a specific period

Formula = Purchases on credit / avg accounts Payable

Days Payable Outstanding (DPO) → Represents the average number of days it takes a company to pay its suppliers

Formula = Accounts Payable / Purchases on Credit * number of days

2️⃣ Accounts Receivable Formulas:

Accounts Receivable Turnover → this measures how many times a company can convert its accounts receivable balance into cash in a given period

Formula = Net Credit Sales / Avg AR balance

Days Sales Outstanding (DSO) → this measures how long it takes on average to collect again your receivables

Formula = Accounts Receivable / Net Credit Sales * Number of Days

Bad Debt Expense ratio → This show you how much you can expect to have in bad debt for each dollar in AR

Formula = Bad debt expense / Total Credit Sales

That’s my take on AP & AR...but there's so much more to it

What would you add?

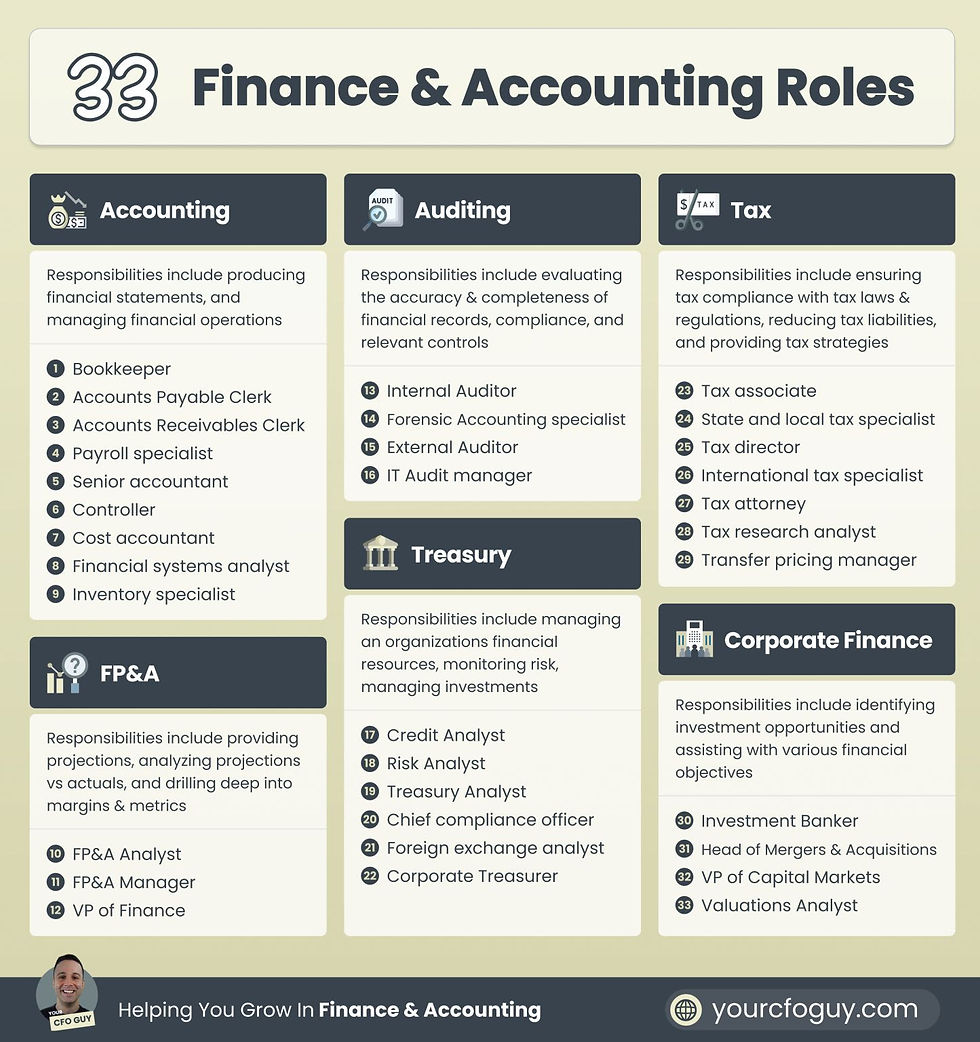

Finance & Accounting continues to be one of the most versatile fields, yielding incredible ROIs for anyone who decides to pursue a background in Finance & Accounting

Here are a list of 33 roles spanning a range of areas & levels of seniority across the profession

◼️ Accounting → Responsibilities include producing financial statements, and managing financial operations

1. Bookkeeper

2. Accounts Payable Clerk

3. Accounts Receivables Clerk

4. Payroll specialist

5. Senior accountant

6. Controller

7. Cost accountant

8. Financial systems analyst

9. Inventory specialist

◼️ FP&A → Responsibilities include providing projections, analyzing projections vs actuals, and drilling deep into margins & metrics

1. FP&A Analyst

2. FP&A Manager

3. VP of Finance

◼️ Auditing → Responsibilities include evaluating the accuracy & completeness of financial records, compliance, and relevant controls

1. Internal Auditor

2. Forensic Accounting specialist

3. External Auditor

4. IT Audit manager

◼️Treasury → Responsibilities include managing an organizations financial resources, monitoring risk, managing investments

1. Credit Analyst

2. Risk Analyst

3. Treasury Analyst

4. Chief compliance officer

5. Foreign exchange analyst

6. Corporate Treasurer

◼️ Tax → Responsibilities include ensuring tax compliance with tax laws & regulations, reducing tax liabilities, and providing tax strategies

1. Tax associate

2. State and local tax specialist

3. Tax director

4. International tax specialist

5. Tax attorney

6. Tax research analyst

7. Transfer pricing manager

◼️ Corporate Finance → Responsibilities include identifying investment opportunities and assisting with various financial objectives

1. Investment Banker

2. Head of Mergers & Acquisitions

3. VP of Capital Markets

4. Valuations Analyst

And then ofcourse…there’s one more role - the grand daddy (or mommy) of them all…

The Chief Financial Officer

I had trouble putting this role in a specific area, since a Chief Financial Officer can have their hand in almost any of these areas, depending on the nature & size of the organization

Those are 33 roles that I’ve seen - there are countless more

What would you add?

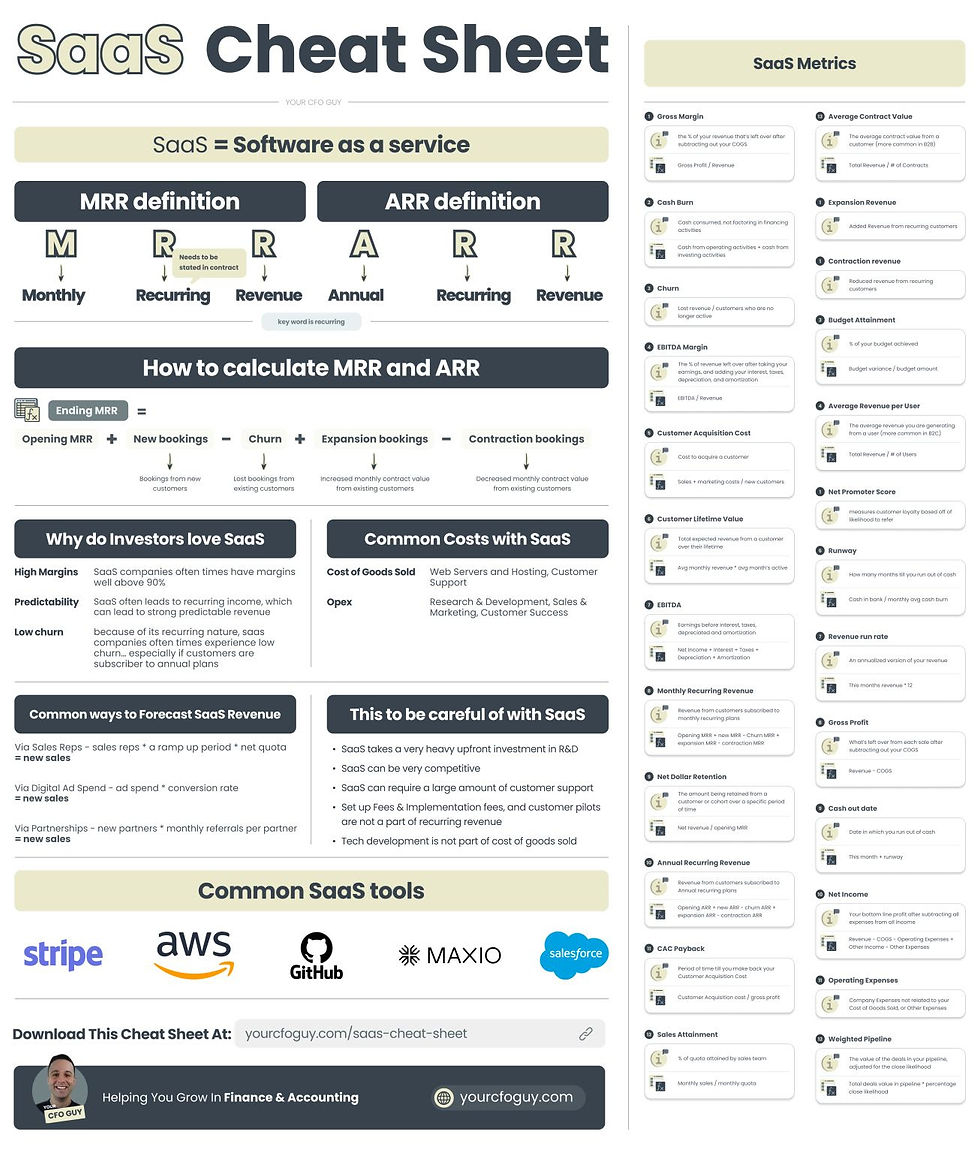

I’ve worked with dozens of SaaS founders over the last few years as a fractional CFO to help them understand their business, report to investors, and raise capital

This is everything I know about the space 👇

➡️What does SaaS mean?

SaaS stands for Software as a Service, which means the end product you are selling to customers is software…

This can be different from a company for example who is selling widgets

Many companies in today have some sort of SaaS component with what they are selling

➡️ How does the business model work?

With SaaS, it’s very common to charge customers on a recurring basis.

The 2 phrases you may have heard on this are:

MRR → Monthly Recurring Revenue

ARR → Annual Recurring Revenue

➡️How do you calculate MRR and ARR?

Using MRR as an example, take your opening balance, and then layer in:

New MRR → recurring income from new customers

Churn MRR → lost income from customers who opt out entirely

Expansion MRR→ added income from customers who are already active

Contraction MRR → reduced income from customers who are still active

➡️Why do Investors love SaaS?

1️⃣ High Margins - SaaS companies often times have margins well above 90%

2️⃣ Predictability - SaaS often leads to recurring income, which can lead to strong predictable revenue

3️⃣ Low churn - because of its recurring nature, SaaS companies often times experience low churn…especially if customers are subscribed to annual plans

➡️ What are some Common Costs with SAAS?

1️⃣ Cost of Goods Sold → Web Servers and Hosting, Customer Support

2️⃣ Opex → Research & Development, Sales & Marketing, Customer Success

➡️ What are some Common ways to Forecast SaaS Revenue?

1️⃣ Via Sales Reps - sales reps * a ramp up period * net quota = new sales

2️⃣ Via Digital Ad Spend - ad spend * conversion rate = new sales

3️⃣ Via Partnerships - new partners * monthly referrals per partner = new sales

➡️ What are some things to be careful of with SAAS?

1️⃣ SaaS can require a very heavy upfront investment in R&D

2️⃣ SaaS can be very competitive

3️⃣ SaaS can require a large amount of customer support

4️⃣ Set up Fees & Implementation fees, and customer pilots are not a part of recurring revenue

5️⃣ Tech development is not part of cost of goods sold

➡️ What are some common SaaS Metrics?

So many…but linkedin won’t allow me to add more due to the 3,000 character limit. Check out the infographic below

📣 If you’re a SaaS founder who is in need of getting a grip on your financial data, I’d love show you what I can do. Feel free to send me a message or drop me an email 📣

This wraps up this week’s edition of Legit Numbers.

I hope you enjoyed reading it and learned something new. If you did, please take a moment to share your feedback here. It would mean a lot to me and help me improve the newsletter.

Also, if you have any suggestions for topics you’d like me to explore in the future, please reply to this email and let me know. I appreciate your input and support.

See you next week!