Josh Aharonoff

May 4, 2023

Welcome to this week's edition of Legit Numbers - it's a pleasure to have you here!

Each week we cover key topics around Finance & Accounting to help you excel in your career, and understand your businesses finance that much better

What we’ll be covering in this edition:

13 Cash Flows Formulas

PivotTable Profit and Loss

The 3 Financial Statements

Master your Debits & Credits

The 4 Fundamentals to Accounting

Let's dive in...

Cash is King

But before you can wear the crown...you need to know how to measure it

Here are 13 formulas to help you master your Cash Flows:

1️⃣ Operating Cash Flow (OCF):

Formula → Net Income + Depreciation + Amortization + Other Non-Cash Items - Changes in Working Capital

2️⃣ Free Cash Flow (FCF):

Formula → Operating Cash Flow - Capital Expenditures

3️⃣ Cash Conversion Cycle (CCC):

Formula → Days of Inventory Outstanding + Days of Sales Outstanding - Days of Payables Outstanding

4️⃣ Net Cash Flow:

Formula → Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

5️⃣ Discounted Cash Flow (DCF):

Formula → CF1 / (1+r)1 + CF2 / (1+r)2 + ... + CFn / (1+r)n, where CF is cash flow, r is the discount rate, and n is the number of periods.

6️⃣ Present Value:

Formula → CF / (1+r)^t, where CF is cash flow, r is the discount rate, and t is the number of periods.

7️⃣ Future Value:

Formula → CF x (1+r)^t, where CF is cash flow, r is the interest rate, and t is the number of periods.

8️⃣ Payback Period:

Formula → Initial Investment / Annual Cash Flow

9️⃣ Operating Cash Flow to Sales Ratio:

Formula → Operating Cash Flow / Net Sales

🔟 Cash Ratio:

Formula → (Cash + Marketable Securities) / Current Liabilities

1️⃣1️⃣ Cash Burn:

Formula → Cash from Operating Activities + Cash from Investing Activities

1️⃣2️⃣ Unlevered Free Cash Flow:

Formula → EBIT x (1 - Tax Rate) + Depreciation & Amortization - Capital Expenditures - Increase in Net Working Capital

1️⃣3️⃣ Levered Free Cash Flow:

Formula → EBITDA - Taxes - Capital Expenditures - Changes in Net Working Capital - Interest Expense

Creating a Profit and Loss PivotTable has many benefits

1️⃣ Easily extend dates using timeline slicers

When you create a PivotTable, you can add what’s called a timeline slicer

That makes it really easy for you to control the dates that you’re showing with just the click of a button

2️⃣ Expand and collapse fields

PivotTables make is really simple to expand details of any fields that you want to expand

Here I segmented by operating expenses by cost type…

allowing me to see a quick glance of what I’m spending across each category

and then I can expand to see the accounts that make up that cost category / section with the click of a button

3️⃣ Double click to drill into details

With PivotTables, you can easily generate a report showing the details behind any totals by just double clicking on the value

After you double click, a new tab will be created instantly showcasing all of the details behind that value

4️⃣ Set slicers to filter for different sections

Looking to only show a segment of your Profit & Loss?

Perhaps you only want to see results for a specific department

Or perhaps you only want to see your Revenue & COGS

When you create a slicer, updating the report for those values is as simple as a click of a button

5️⃣ PivotCharts are a game changer

PivotCharts put your charts on steroids

It allows you to control the outputs from your chart just as much ease as you would control a PivotTable

So when you update a slicer, or a timeline

The chart automatically updates as well

There are many other benefits of using PivotTables…these are just a few

Get this template by click the image below

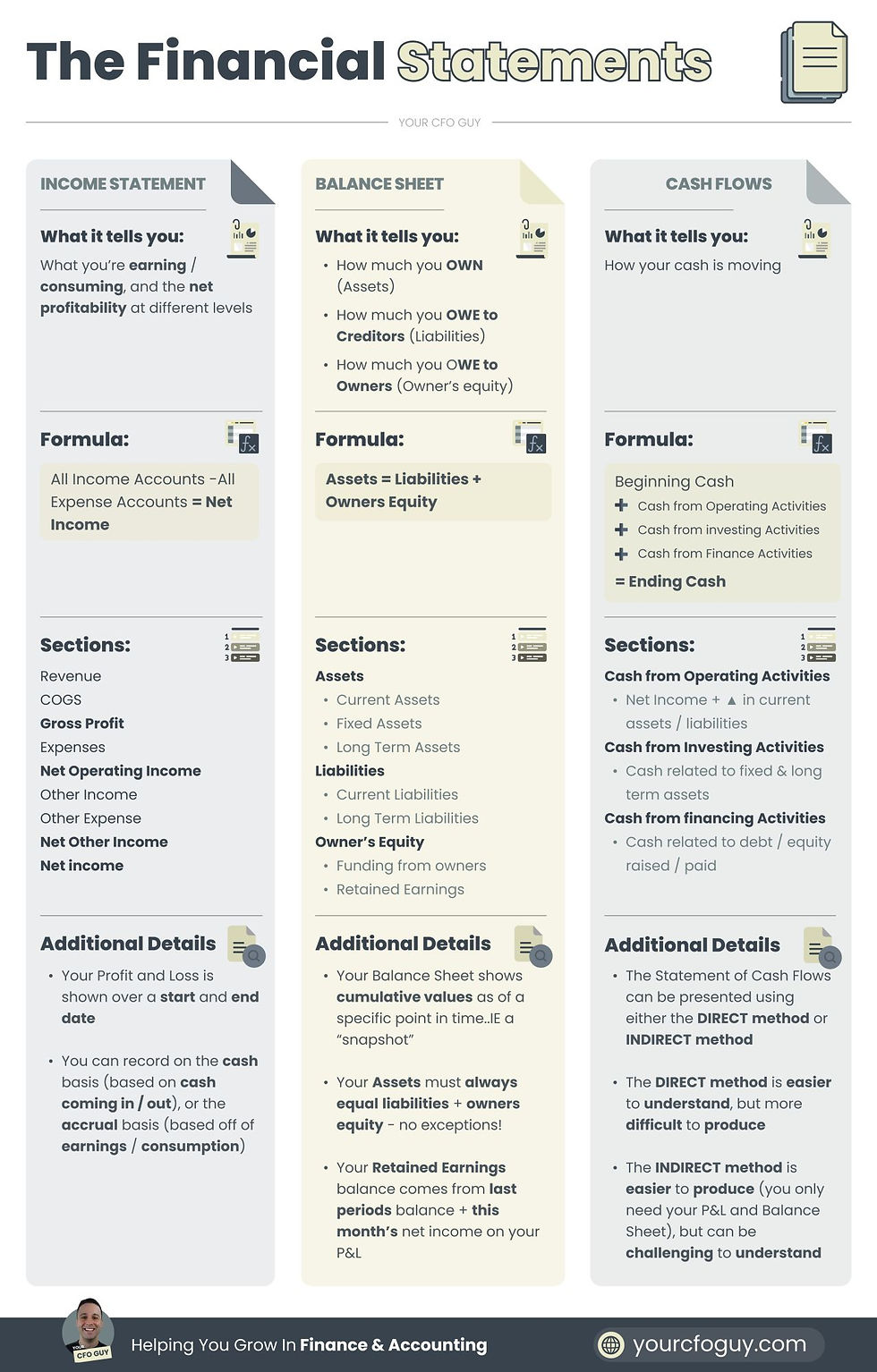

These 3 statements are affected by close to every action taken in your Finance & Accounting department

Let's take a deep dive on each:

📄 𝐈𝐍𝐂𝐎𝐌𝐄 𝐒𝐓𝐀𝐓𝐄𝐌𝐄𝐍𝐓 (also known as Profit & Loss)

This represents everything in terms of what your company is EARNING...

as well as what your company is SPENDING

Here are the major sections (and what they mean):

⚫ REVENUE

What is being earned via sales

⚫ COGS

The cost to deliver your product or service

⚫ GROSS PROFIT

Your profitability in carrying out your product or service (Revenue - COGS)

⚫ OPERATING EXPENSES

All other costs that relate to your core business, but aren't necessary to carry out your product or service (IE not COGS)

⚫ NET OPERATING INCOME

Gross Profit less Operating Expenses

⚫ OTHER INCOME

Money earned that is not core to the business (common ones can be interest income, or cash back from credit cards)

⚫ OTHER EXPENSES

Expenses that are incurred that are not core to the business (common ones can be depreciation and interest expense)

⚫ NET OTHER INCOME

Other Income - Other Expenses

⚫ NET INCOME

Net operating income + Net other income

📄 𝐁𝐀𝐋𝐀𝐍𝐂𝐄 𝐒𝐇𝐄𝐄𝐓

Here you can see a snapshot of everything the company OWNS (assets)...

while also understanding what the company OWES to creditors (liabilities)...

and the money put into the business through investments & prior profits (owners equity)

It is separated by 3 sections:

⚫ ASSETS

What the company owns / substantially controls that represents economic value.

Common ones are cash, accounts receivable, and prepaid expenses

⚫ LIABILITIES

What the company owes to creditors. Examples can include credit card balances, accounts payable, and deferred revenue

⚫ EQUITY

This is the net value of the company that the owner's can claim, and is typically comprised of amounts invested, and prior earnings (retained earnings)

📄 𝐒𝐓𝐀𝐓𝐄𝐌𝐄𝐍𝐓 𝐎𝐅 𝐂𝐀𝐒𝐇 𝐅𝐋𝐎𝐖𝐒

This statement shows you all of the details that makes up the movements in your cash balance on the balance sheet.

It is comprised of 3 sections

⚫ CASH FROM OPERATING ACTIVITIES

This section shows all of the cash flows from activities related to operating the business

⚫ CASH FROM INVESTING ACTIVITIES

Here you show the cash movements from long term assets

⚫ CASH FROM FINANCING ACTIVITIES

Here you show the cash from all equity investments and debt injected / paid out from the company

This summary is just a brief overview of these 3 statements

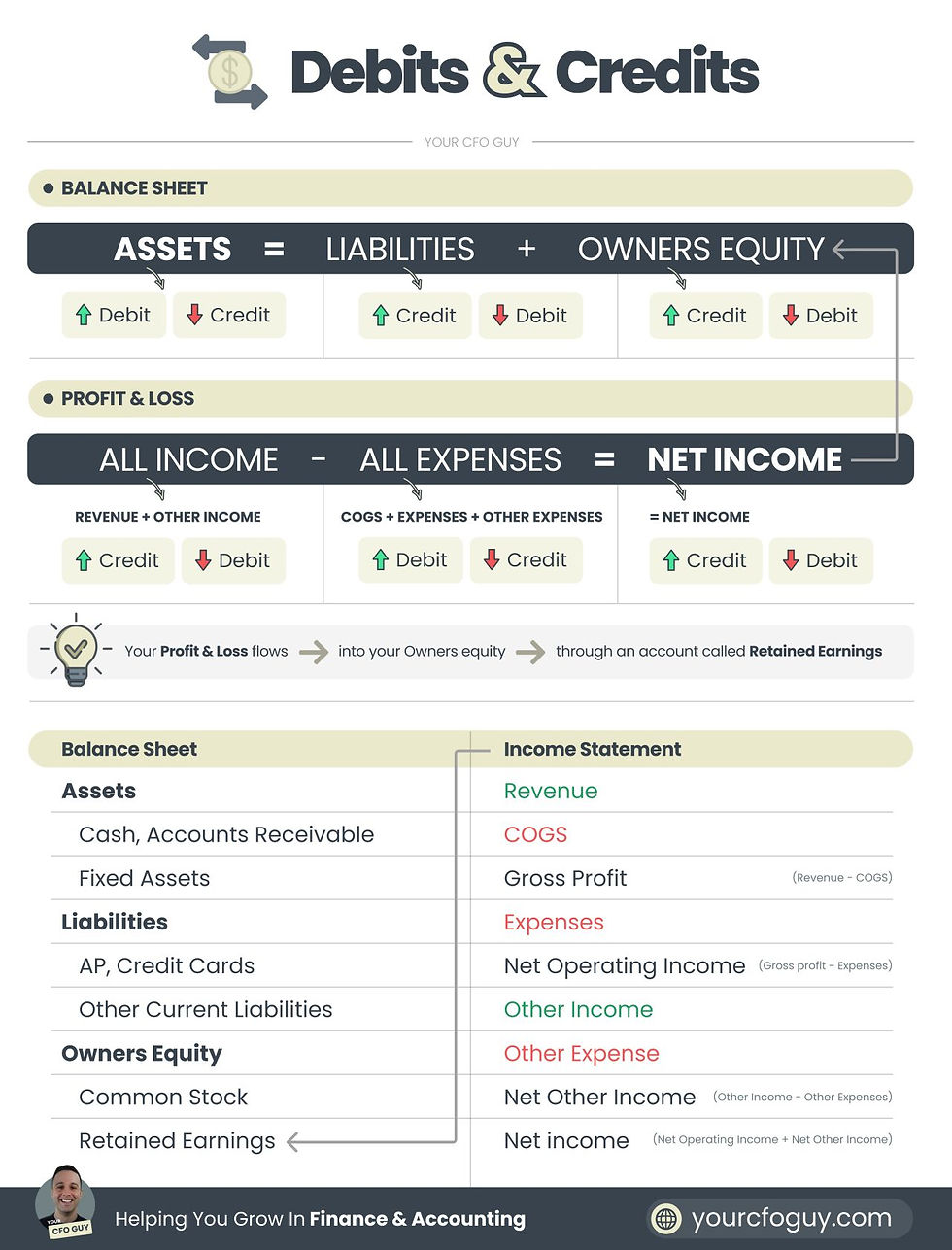

Debits & Credits can be a real challenging concept to grasp when starting off in accounting

They are pretty much a whole new language…and most people think they are too confusing to understand

But they are actually really simple

First..

➡️ What are Debits & Credit?

Debits & Credits are kind of hard to to explain because…well

They aren’t really anything

They are just a way of communicating what is happening to an account in your income statement / balance sheet (IE your general ledger)

They are the way you work with what is famously known as “Double Entry Accounting”

➡️ What is Double Entry Accounting?

This pretty much means that everything financially that happens to a business affects atleast 2 accounts in your general ledger

That’s right…every single financial transaction…

And those 2 “actions” are communicated via debits & credits

➡️ How can I remember when to use a Debit, and when to use a Credit?

OK…so this is where it can get confusing

But it’s actually really simple if you understand this formula

ASSET = LIABILITIES + OWNERS EQUITY

All financial activity affects one or more of these 3 sections of your balance sheet

and when using debits & credits…

The way Assets go up or down…

is the complete OPPPOSITE for how Liabilities + Owners Equity go up or down:

And this is all you need to memorize 👇

Assets —> ⬆️ go UP with DEBITS ⬇️ Go DOWN with CREDITS

Liabilities + Owners Equity —> ⬆️ Go UP with CREDITS ⬇️ Go DOWN with DEBITS

➡️ What about the Profit and Loss?

The key thing to remember is that Your Profit & Loss flows ⏩ into your Owners equity ⏩ through an account called RETAINED EARNINGS

So your Net Income goes UP ⬆️ with Credits

and DOWN ⬇️with Debits

Than means that any P&L account that’s GOOD for your net income (like Revenue)

Will go up by…..?

That’s right - a CREDIT

And things that are BAD for your net income (like COGS / Expenses)

Will go up by…?

Exactly! A DEBIT

What do you think? Was that simple enough for you to understand?

If I had to sum up Accounting in just 4 things, it would easily be these:

1️⃣ Assets = Liabilities + Owners Equity

This one formula pretty much sums up accounting to me…and I imagine most would say the same

It may sound simple, but it is really so deep

Everything your business OWNS (assets)

Was funded by either CREDITORS (liabilities)

Or OWNERS (Equity)

And each of those things have so many examples, and so many things to expand upon

2️⃣ The Financial Statements

These refer to the Profit and Loss, Balance Sheet, and the Statement of Cash Flows

The Profit and Loss tells you how much you’re EARNING

The Balance Sheet shows you What OWN, vs OWE (to creditors & owners)

The Statement of Cash Flows shows you where you’re cash is going

All 3 of these are important…

Though the Profit and Loss + Balance Sheet are usually more popular

Since you can create a Statement of Cash flows using the data from those 2 statements

3️⃣ Debits & Credits

This is pretty much the language that accountants speak

Debits & Credits don’t actually mean anything…

They are just a way of describing whether something is INCREASING, or DECREASING

That means that depending on the type of account…

You can understand what is happening (IE the balance is going up or down), by hearing the words debit or credit

4️⃣ Cash vs Accrual

Cash basis of accounting means you are classifying all money in as income, and all money out as expenses (with some exceptions)…

Accrual basis of accounting means you are classifying income only when it’s EARNED, and classifying expenses only when they are INCURRED…regardless of cash activity

Accrual basis of accounting is much more popular for larger companies, and is required by GAAP

That's a wrap for this week's Legit Numbers!

I hope you found this digest informative and gained some valuable insights into accounting and finance.

As always, I welcome your feedback and suggestions for future topics. If you enjoyed this edition, please consider leaving a testimonial here.

See you next week!